Homeowners- If you can make the payment…..make the payment‼️

Some politicians and governors have made comments as if BANKS will let you skip payments, as if they are doing us all a favor.

Be informed!

Do not skip your payments if you can avoid it!

It’s due April 1st, just like every other month. It’s late on the 15th, just like every other month. Late fees will add up and it will be reported to the credit bureaus on the 31st day, like usual…

If you don’t pay it, two payments will be due May 1st and three payments will be due June 1st. If you don’t have one payment now, will you have three in June? Cause you know what happens if you get to 6? They start the foreclosure process. There are no legit measures in place to protect you!

Here are your options.

1. If you have a job and your rate is over 4-5% you could refinance “if it makes sense” and legally skip a payment. Why not lower your rate, extend your term and lower your payment in the process? Or get some cash out? You may have equity in the house. If you need it, let’s go get it. Or you could sell it too.

2. If you don’t have a job and have a genuine need, CALL YOUR LOAN SERVICER AND ASK FOR HELP! They will help where they can but it typically requires the use of a loan modification. If you don’t have income that’s going to be hard to qualify for.

3. If you are thinking of cashing out your equity and want to sell your house then let’s arrange a video phone call and you can show me the condition and upgrades that you have made so that I can help you establish the value.

The Government has created the CARES Act, to assist homeowners whose income may have been adversely impacted by the coronavirus. One of the components of the CARES Act is the possibility of mortgage forbearance.

Forbearance is often misinterpreted. While it is intended to help, it can also have some dangerous repercussions. Many people are mistakenly thinking that forbearance equals forgiveness. It does not.

What is a Forbearance?

With this option, you and your mortgage company agree to temporarily suspend or reduce your monthly mortgage payments for a specific period of time. This option lets you deal with your short-term financial problems by giving you time to get back on your feet and bring your mortgage current.

Forbearance may be an option if you are:

- Behind on your mortgage payments or on the verge of missing payments

- Experiencing a temporary hardship

What are the benefits?

- Lower or temporarily suspend your monthly payment—giving you time to improve your financial situation and get back on your feet

- Less damaging to your credit score than a foreclosure

- Stay in your home and avoid foreclosure

How does it work?

Forbearance reduces your monthly mortgage payment—or suspends it completely—during the forbearance period. If you qualify for forbearance, you and your mortgage company will discuss the forbearance terms:

- length of forbearance period,

- reduced payment amount (if the payment is not suspended), and

- the terms of repayment.

After the forbearance period has ended, you will need to repay the amount that was reduced or suspended. However, there are a few options available if you qualify— make a one-time payment for the amount due (reinstatement); add a specific amount to your payments each month until the entire amount is repaid (see Repayment Plan); or cure the past due amount through a modification (see Modification).

Forbearance means that the payments will be suspended for a short period of time, initially up to 6 months, but will need to be caught up when the forbearance period is over.

Think about when you buy something at a furniture store that offers “no payments” for 3 months.

You still must pay for the furniture…the payments are just deferred.

Imagine not making your mortgage payments for 6 months. Beginning in April 2020 through September 2020. With your October 2020 payment, the entire 6 months of payments plus your October payment could be due all at once. Mortgage forbearance can be worse if the amount owed accumulates for long periods of time. Should this happen, the lender will enforce their right to be paid, which may cause the borrower to be foreclosed upon and ultimately lose their home.

Forbearance is designed to help those as a measure of last resort. It is not a free pass and may have serious consequences.

Depending on your situation, I may be able to help by eliminating your debts, lowering your payment, and giving you a cash cushion during these turbulent times. Please reach out to me directly with any questions you may have during this time. As well, if you are experiencing financial hardship, it is extremely important that you reach out to your mortgage servicer to discuss options and fully understand those options before you miss any mortgage payments.

Please be informed. Don’t just stop paying your mortgage. Banks are not protected and they will not protect us.

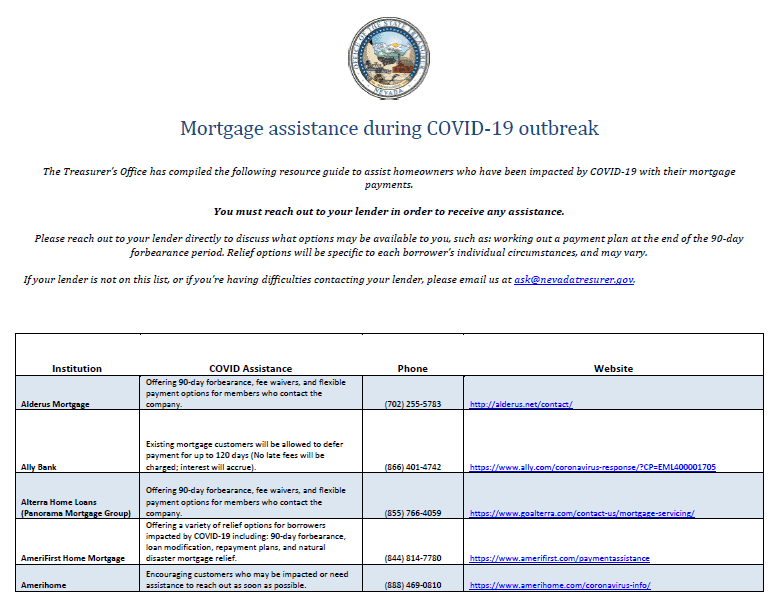

Please see this PDF file on Mortgage assistance during COVID-19 outbreak